Bond Market: Yields, Cycles & Outlook

Advertisements

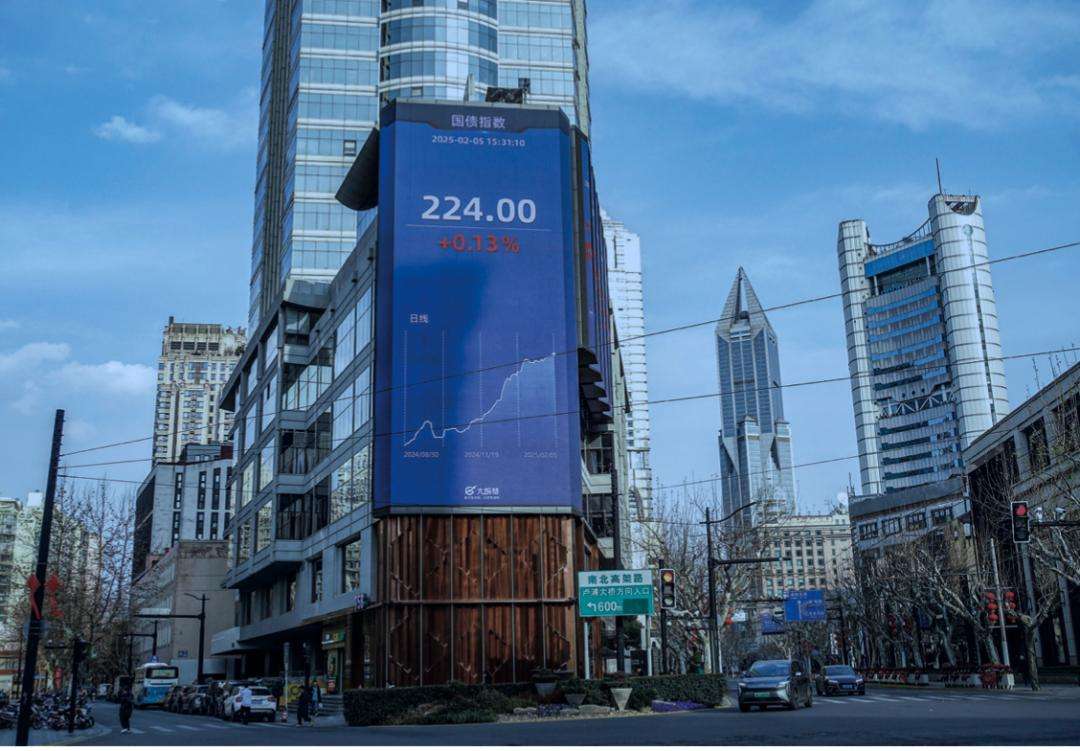

The recent trends in the Chinese bond market reveal a complex interplay between economic conditions, monetary policy, and investor behavior. As the nation approached the Lunar New Year in January 2025, the bond market dramatically shifted away from its earlier bullish sentiment, transitioning into a phase characterized by volatility and fluctuations in yields. By January 24, 2025, short to medium-term government bond yields, encompassing durations of one, three, and five years, had rebounded from their recent lows by approximately 45 basis points, 25 basis points, and 12 basis points respectively. This upward movement reflected a broader trend where bond prices initially surged, only to retract, highlighting the dynamic nature of investor sentiment and market conditions.

Throughout 2024, the bond market experienced what was referred to as an "epic bull market," driven by a reported scarcity of secure investment options. Despite an overall downturn in yields during the year, the rebound in early 2025 indicated a market grappling with shifting expectations and economic forecasts. With government bonds, particularly those with longer maturities, showcasing historical lows in yields—1.63% for ten-year bonds and 1.80% for thirty-year bonds as of February 13—investors faced a perplexing dilemma between the appeals of high returns on bonds and the hidden risks of potential yield increases.

As insights from the People's Bank of China (PBOC) emerged, officials cautioned about the risks associated with long-term bond yields. The central bank's former monetary policy division head highlighted the sensitivity of these yields to changes in economic fundamentals and market supply-demand dynamics. A compelling example underscored this risk: should the yield on thirty-year bonds rise by 30 basis points, corresponding prices in the secondary market could plummet by over 5%. Such volatility creates potential for substantial short-term losses for institutional investors.

The monetary landscape leading into 2024 involved cautious management of liquidity, especially as policymakers sought to support a recovering economy. A notable shift saw the central bank transitioning its approach from simply maintaining "reasonable liquidity" to ensuring an "ample supply" in the financial system—an adjustment aimed at mitigating risks and stimulating growth. In this context, many financial institutions leaned towards bond investments as a strategic alternative to address liquidity management amidst waning credit demand.

Yet, the landscape began to tighten, with rising pressures on the renminbi and the U.S. dollar gaining strength. This situation compelled the PBOC to prioritize tightening market liquidity, with indicators such as the DR007—the benchmark for assessing liquidity—soaring to a near two-year high of 2.34% around that time. As the Chinese bond market faced increasing constraints on available liquidity, traders reported significant spikes in short-term borrowing rates: In a matter of days, rates for overnight borrowing surged dramatically, reaching alarming levels of up to 20% for non-bank financial institutions.

This tightening environment raised alarms among market participants, many of whom anticipated that the central bank would ease liquidity pressures. However, when the PBOC opted against injecting more capital into the banking system, a wave of selling ensued in the bond market, resulting in rising yields across various maturities. Traders who had hoped for a continuation of low-interest rates found themselves scrambling, as overnight rates surged and led to increased selling of government securities.

However, despite the forecasts for lower yields amid declining liquidity, experts underscored that the bond market might have already anticipated low interest rates, potentially leading to a ceiling on future upside. With projections suggesting that market conditions had already discounted significant interest rate cuts, analysts warned that the space for continued declines in bond yields could be constrained. Major financial institutions, reflecting on the swift decreases in yields, began to temper expectations regarding substantial gains in the market in 2025 and beyond.

Looking back to 2024, the precipitous decline in bond yields was largely driven by the combination of fundamental economic pricing and enhanced expectations surrounding monetary policy easing. The transition from a "prudent" to a "moderately accommodative" policy stance marked a significant shift in the central bank's approach to addressing economic stagnation. As policymakers implemented increased measures to bolster liquidity, reductions in bond yields became considerable, fueling expansive returns for fixed-income investments. In 2024, the ten-year bond yield fell sharply to roughly 1.68% at year's end—a drop of about 88 basis points—while 30-year bonds also saw significant declines.

This epic bull market, which saw numerous bond funds outperforming equity benchmarks, highlighted the contrasting fortunes of different asset classes. Global investment analysts lamented how, in an environment awash with liquidity, aggressive investment strategies had become common, leading to distortive effects on bond pricing—where high-risk trading behavior inadvertently nudged yields lower as market dynamics pushed institutional confidence to new extremes. The need for regulatory oversight became paramount as concerns arose about those holding excessive exposure to long-term debt amidst an evolving economic landscape.

As financial analysts contemplated the future trajectory of the bond market, they suggested that while initial expectations of continued bullish performance were premature, certain factors would critically influence performance in the months ahead. Many anticipated consolidations in bond yields, particularly if pivotal economic indicators failed to align with existing speculative forecasts.

Ultimately, the unfolding narrative in China’s bond market showcases a complex dance of recovery, speculation, and caution—a climate where financial institutions and investors alike must navigate the ever-evolving landscape of opportunities against a backdrop of heightened risk. As they brace for what lies ahead, adapting their strategies and managing liquidity effectively will be pivotal for maintaining stability amid potential churn in the market.

Leave A Reply